Support for Remote Work and Digital Economy: Changes to income tax laws will facilitate remote work opportunities for Nigerians, empowering youths in the global digital economy.

Promotion of Exports: Zero-rated VAT and other incentives aim to encourage exports in goods, services, and intellectual property.

Relief for Small Businesses: Small businesses with an annual turnover of ₦50 million or less will benefit from tax exemptions, including withholding tax, VAT, and a 0% corporate income tax rate.

Reduced Personal Tax Burden: Minimum wage earners will be exempt from PAYE, and over 90% of workers in the private and public sectors will experience reduced tax burdens.

Essential Goods Exemptions: VAT exemptions on food, education, healthcare, rent, public transportation, fuel products, and renewable energy will alleviate the cost of living, especially for low-income households.

Corporate Tax Relief: Corporate income tax rates will reduce from 30% to 25% over two years, and loss-making companies will no longer face minimum tax.

Harmonized Tax System: Earmarked taxes on companies will be eliminated, replaced by a unified, lower single levy.

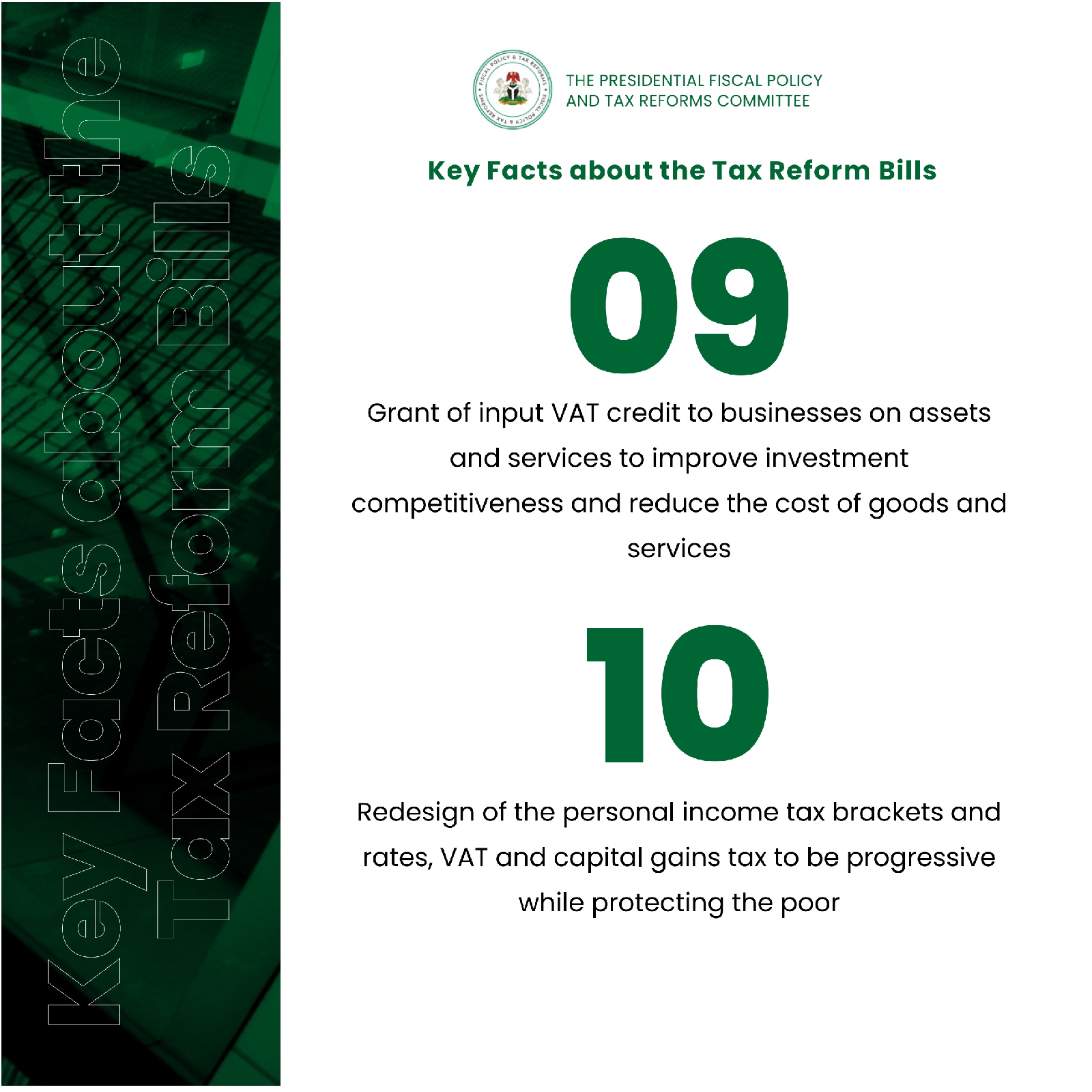

Enhanced Business Investment: Businesses will receive input VAT credits on assets and services, enhancing investment competitiveness and reducing costs.

Equitable Revenue Sharing: VAT revenue sharing will be more equitable to ensure fair treatment of states with fewer headquarter companies.

Simplified Compliance: Allowing taxes on foreign currency transactions to be paid in naira reduces exchange rate pressures and simplifies compliance.

Economic Contributions Rewarded: The rationalization of tax incentives aims to provide a level playing field and reward states' economic contributions.

New National Fiscal Policy: The policy emphasizes fair taxation, responsible borrowing, and sustainable spending.

These reforms aim to create a more inclusive, equitable, and competitive economic environment for all citizens.

No comments:

Post a Comment